MISE À JOUR : 1 AOÛT 2025

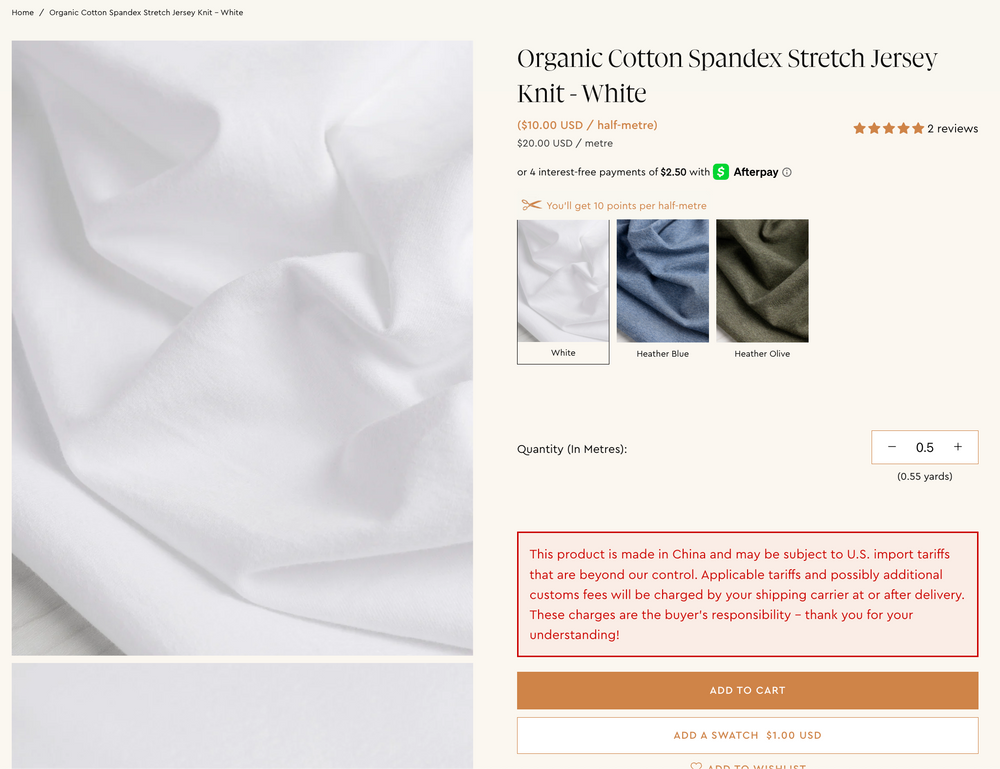

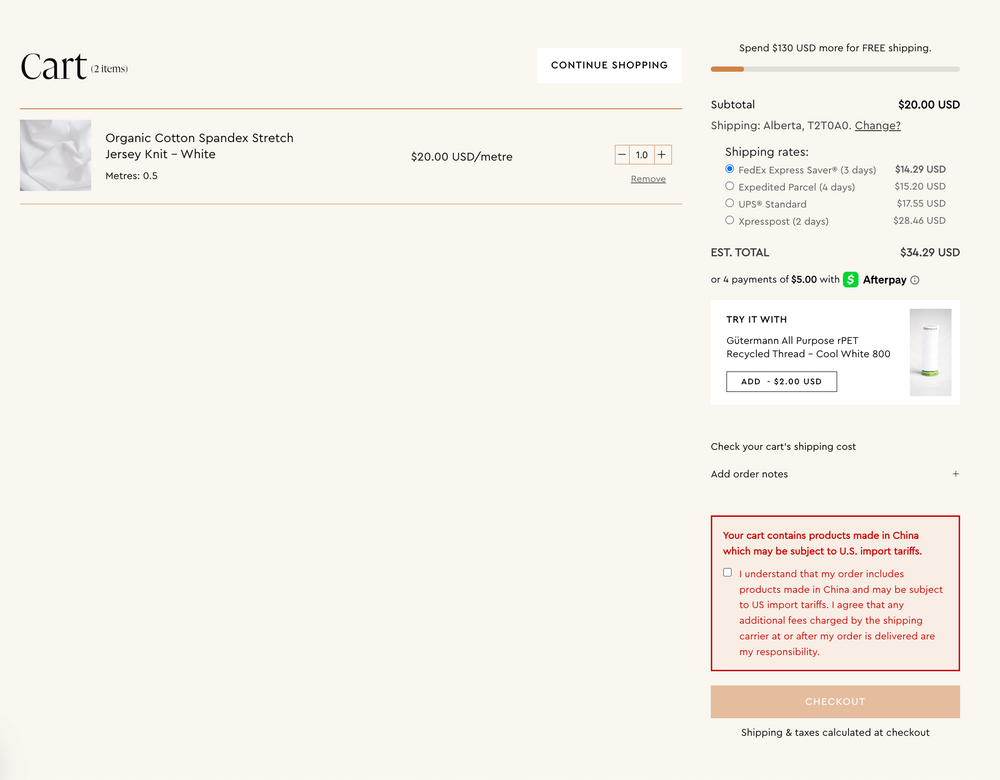

Le 30 juillet, le président Trump a signé un décret mettant fin à l’exemption de droits de douane pour les importations d’une valeur inférieure à 800 $ USD, qui étaient jusqu’alors exemptées. À compter du 29 août, tous les colis entrant aux États-Unis pourraient être soumis à des droits de douane — quelle que soit leur valeur ou leur pays d’origine.

Nous travaillons actuellement à mettre à jour notre site afin de refléter ce changement aussi clairement que possible. D’ici là, nous encourageons nos clients américains à passer leurs commandes de moins de 800 $ USD avant le 21 août. Cela nous permettra d’avoir suffisamment de temps pour traiter et expédier votre commande afin qu’elle puisse encore bénéficier d’une livraison sans droits de douane, tant qu’elle n’inclut pas de produits d’origine chinoise.

Pour faciliter vos achats, nous avons créé une collection spéciale sans droits de douane regroupant les articles éligibles.

Merci de votre soutien et de votre compréhension alors que nous nous adaptons à cette nouvelle réglementation.

Pour des informations officielles, veuillez consulter la fiche d’information de la Maison-Blanche.

Thank you for your continued support and understanding as we navigate this policy change.

For official information, refer to the White House fact sheet.