UPDATE: APRIL 25th 2025

Starting May 2, 2025, the U.S. government will end duty-free (de minimis) treatment for goods from China and Hong Kong. This means that all products of Chinese origin imported into the U.S. will now be subject to applicable duties, tariffs, and taxes. This change stems from an official Presidential Executive Order issued by the White House. You can read the full text of the Executive Order here.

As a result, any applicable US import fees will be billed by your shipping carrier at or after delivery, and these charges are beyond our control and are the responsibility of the customer. Please note that shipments into the US WITHOUT Chinese goods will continue to be tariff free, provided they do not exceed the $800 de minimis exemption (more on that below).

Fortunately we have always worked hard to build a diverse and robust supply chain around the world, and only a small percentage of our products will be affected. In addition, we’re actively working to replace the products we are currently sourcing from China. In the meantime, existing made-in-China products will incur these additional import costs.

To help make things easier and more transparent for our U.S. customers, we’ve added a few key features to our website:

This collection includes all products not made in China; choosing products from this collection ensures your order will continue to qualify for duty-free entry under the $800 USD de minimis exemption.

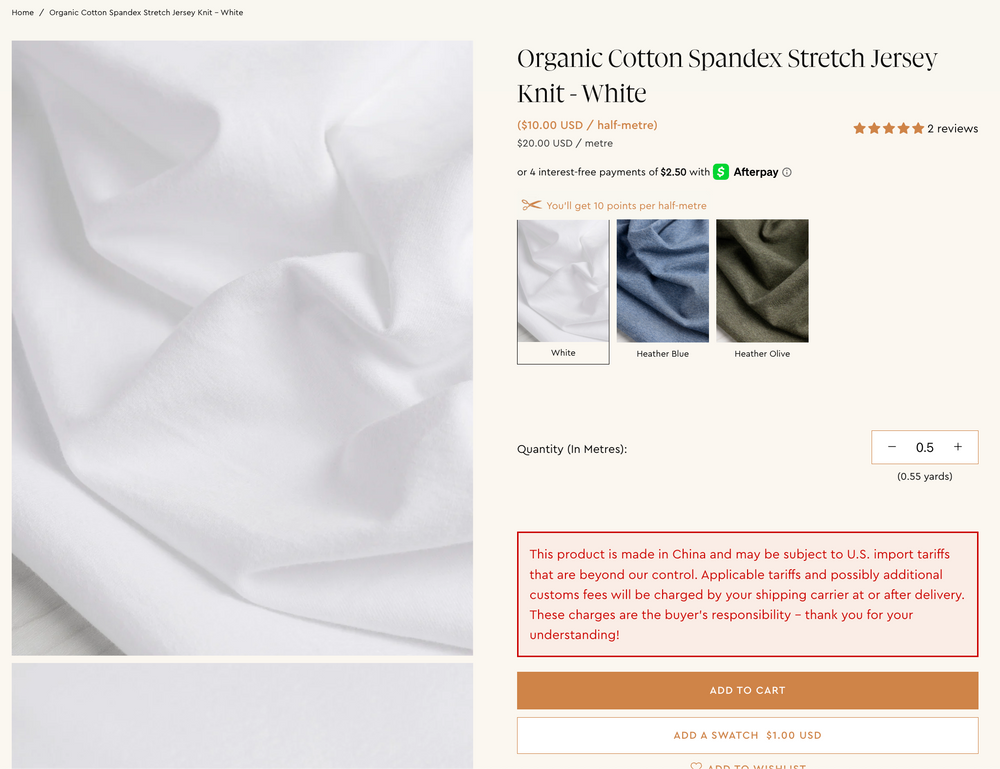

Clear product notices

Any item made in China now includes a clear note on the product description page, so you’ll know in advance if US import tariffs will apply.

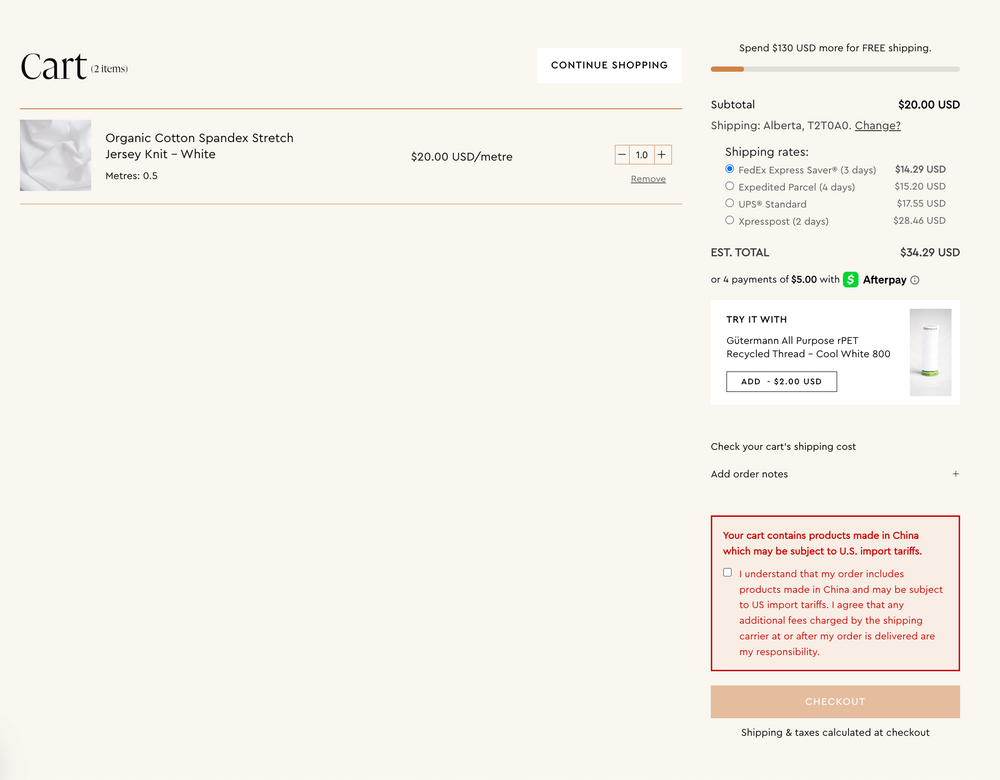

Checkout Opt-In

If your cart includes items made in China, a popup at checkout will ask you to confirm that you understand US import fees may apply and will be your responsibility upon or after delivery.

Good to know: Orders under $800 USD that include only non-Chinese-made items will continue to ship duty-free to the U.S for now.

We appreciate your understanding and support. As always, we’ll keep you informed as new updates become available.